Ocasio Cortez 70% Tax

- Ocasio Cortez 70% Tax

- Alexandria Ocasio Cortez Net Worth

- Ocasio Cortez 70% Tax Rate

- Ocasio Cortez 70% Tax Rate Yahoo

- Alexandria Ocasio Cortez Parents Wealth

Ocasio-Cortez suggests a 60 to 70 percent tax rate for the rich to pay for a 'Green New Deal'

Ocasio-Cortez Stumbles on 70% Tax Reality When socialists discuss the funding side of a vast social entitlement, they always get into trouble. Alexandria Ocasio-Cortez wants to debunk misleading representations of her proposed 70% marginal tax rate.Subscribe To 'The Late Show' Channel HERE: htt.

Americans for Tax Reform director of strategic initiatives Paul Blair weighs in on Ocasio-Cortez’s proposed tax hike.

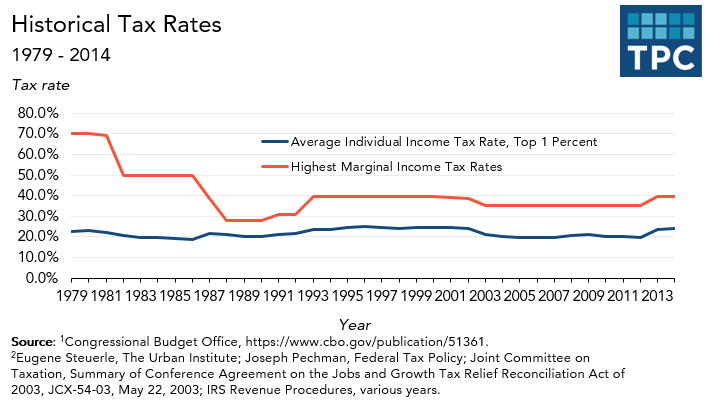

Congresswoman Alexandria Ocasio Cortez, D-N.Y., recently announced that Democrats should increase the top personal income tax rates as high as 70 percent. That would be the highest income tax rate in the developed world, higher than all of our major trading partners and competitors.

For decades polls have shown that most Americans believe no one should pay more than 25 percent of their income in taxes. (That is how much serfs paid in the Middle Ages.)

Ocasio-Cortez is not alone. The Democratic Party in the House chose to begin 2019 demanding higher taxes. They have already voted down an amendment offered by Republican Ways and Means ranking member Kevin Brady to make the standard deduction and child tax credit permanent (Now they expire in ten years like the Bush tax cuts of 2001.)

If Democrats allow all of the personal income tax cuts in the Tax Cuts and Jobs Act to lapse, it will result in a significant tax hike of $2,058 per year for a family of four earning $73,000.

Then Democrats got rid of the Republican House rule that required a three-fifths majority vote to hike taxes. Democrats refused to require a three-fifths vote to hike taxes on low or middle-income Americans. They made it easier to raise taxes on all Americans.

Ocasio-Cortez was a toddler when the Democrats controlled the House, Senate, and White House in 1993. They raised the income tax—not to 70 percent—but to 39.6 percent. The Democrats then lost the House and Senate in 1994.

Ocasio Cortez 70% Tax

Ocasio-Cortez was 19-years-old in 2008 when once again the Democrats won the House, Senate and presidency. Obama and Pelosi (who should now know better) raised the income tax top rate to just over 40 percent and lost the House and their Senate supermajority in 2010.

History is about to repeat itself in 2020. The Democrats are showing bared teeth and American taxpayers have a history of responding poorly to tax hikes dating back to 1773.

It gets worse

Ocasio-Cortez’s income tax hike is only one of several tax hikes being threatened.

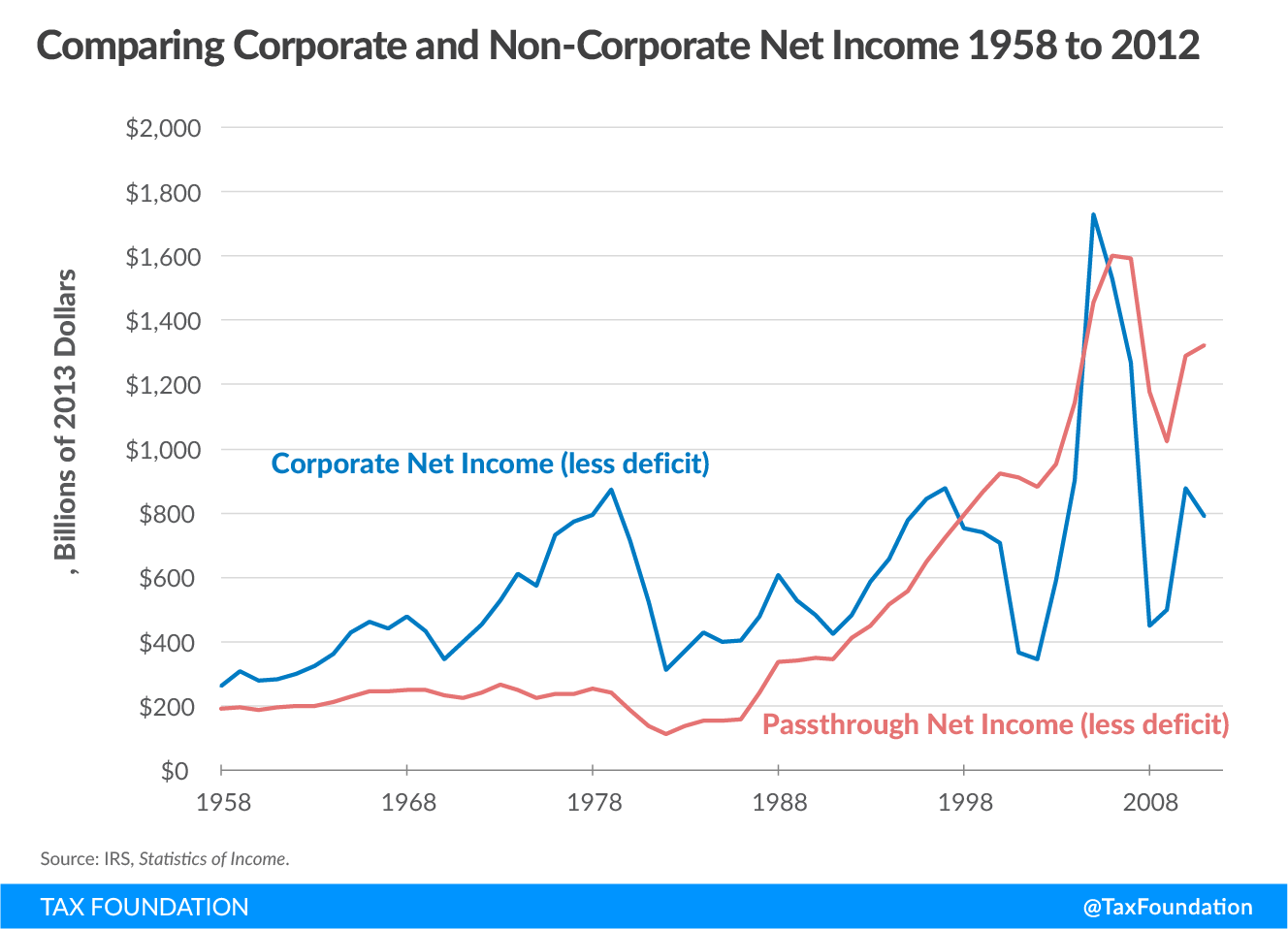

Congressman John Yarmouth, D-Ky., now the chairman of the House budget Committee told Politico that he expected Democrats to push to raise the corporate income tax from 21 percent to 25 or 27 percent. Add in our average state corporate income taxes and America would tax its business more than China (25 percent) or Germany (25 percent).

But wait, there is more. The Democratic party platform calls for a tax on carbon dioxide, an energy tax. One “carbon tax” plan introduced by Democrat congressman Ted Deutch of Florida would increase taxes on energy by $1 trillion over the next ten years and that energy tax would automatically increase without any vote by Congress.

Should we care about the threat to hike the top personal income tax rate to 70 pecent? Ocasio-Cortez promises that her top rate would only hit those earning more than $10 million a year. Maybe most of us are safe?

Let's first look at some history. The personal income tax was imposed in 1913. The top tax rate on the very rich was 7 percent. We were all promised then that the new income tax was “a tax on the rich.” The one percent. In today’s dollars that 7% rate only hit those earning more than $11 million (sounds like the plan Democrats like AOC are pushing.) But within a few years, the lowest rate went above 7 percent. Today the bottom rate is 10 percent -- higher than the punitive tax rate that was supposed to hit only the Kennedy and Rockefeller kids.

New taxes are often imposed on “the rich” or “them.” Then over time, they trickle down to hit all of us. That is what happened with the personal income tax. Once targeted to the top one percent but now hitting half of Americans.

Then there was the Spanish American War tax, a tax on long distance phone calls in 1898 when only the very rich owned phones. Over time all Americans had phones at home and we all paid the federal excise tax on every long-distance phone call—for one hundred years.

Tax hikes on the rich never stay so focused. They slip down to hit the rest of us.

Promising to “soak the rich” is a popular ruse to misdirect the attention of voters to ignore taxes.

Alexandria Ocasio Cortez Net Worth

Politicians like to misdirect your attention by talking about “taxing the rich” while they are enacting energy taxes that hit everyone who drives a car, heats their home or uses lights or air conditioning. And taxes on businesses are simply hidden taxes placed into the higher cost of everything we buy each day.

Bill Clinton promised he would only raise taxes on the top 2 percent of earners. He then raised gas taxes on everyone.

Obama promised, over and over, that he would never raise ANY taxes on ANYONE earning less than $250,000. But ObamaCare included at least seven direct tax increases on Americans making less than $250,000.

Ocasio Cortez 70% Tax Rate

Ocasio-Cortez’s 70 percent income tax rate is the opening shot in a renewed war against middle class taxpayers. One might hope she is alone in this effort. But to date, not a single elected Democrat has denounced this opening gambit in the drive for higher income taxes, business taxes and energy taxes.

Ocasio Cortez 70% Tax Rate Yahoo

The new European data protection law requires us to inform you of the following before you use our website:

Alexandria Ocasio Cortez Parents Wealth

We use cookies and other technologies to customize your experience, perform analytics and deliver personalized advertising on our sites, apps and newsletters and across the Internet based on your interests. By clicking “I agree” below, you consent to the use by us and our third-party partners of cookies and data gathered from your use of our platforms. See our Privacy Policy and Third Party Partners to learn more about the use of data and your rights. You also agree to our Terms of Service.